Last week, Fond was honored to sponsor the 2021 CUNA HR & Organizational Development Council Virtual Conference. The conference featured a series of speaker sessions, networking events, and roundtables packed full of insights from senior HR leaders across the credit union industry.

As the employee recognition partner of credit unions like Members 1st Federal Credit Union and Golden 1 Credit Union, Fond is dedicated to supporting a standout employee experience at financial services organizations. Whether you’re a leader at a credit union or operating in another industry, there was much to be learned about the future of HR throughout the conference. Below we share five of the most important things we learned:

As the employee recognition partner of credit unions like Members 1st Federal Credit Union and Golden 1 Credit Union, Fond is dedicated to supporting a standout employee experience at financial services organizations. Whether you’re a leader at a credit union or operating in another industry, there was much to be learned about the future of HR throughout the conference. Below we share five of the most important things we learned:

1. Acquiring the Right Talent Will Make or Break Your Credit Union

Many recommendations shared at the conference focused on providing more autonomy and flexibility for employees. Michael Barata, Master Trainer at CultureRx, spoke to the importance of trust and accountability for companies adopting a more open, results-oriented approach to work. According to Barata, these two things are the key ingredients that make the difference between total chaos and productive freedom.

This makes sense in theory, but in practice, how do you go about building trust and accountability into your culture?

To start, you need to know you’re working with a team of reliable, driven, and trustworthy individuals. Trent Savage, CHRO at Mountain America Credit Union, called it “getting the right people on the bus.” Savage explained, “Where I’ve seen a lot of organizations fail is they’re not willing to get the right people on the bus. They may get the org design right, but then they try to make that org design work with the talent they have. Sometimes the reality is that the people we have are not going to play at the strategic level.” In other words, if you’re not able to bring the right talent on board, your goals won’t be actualized.

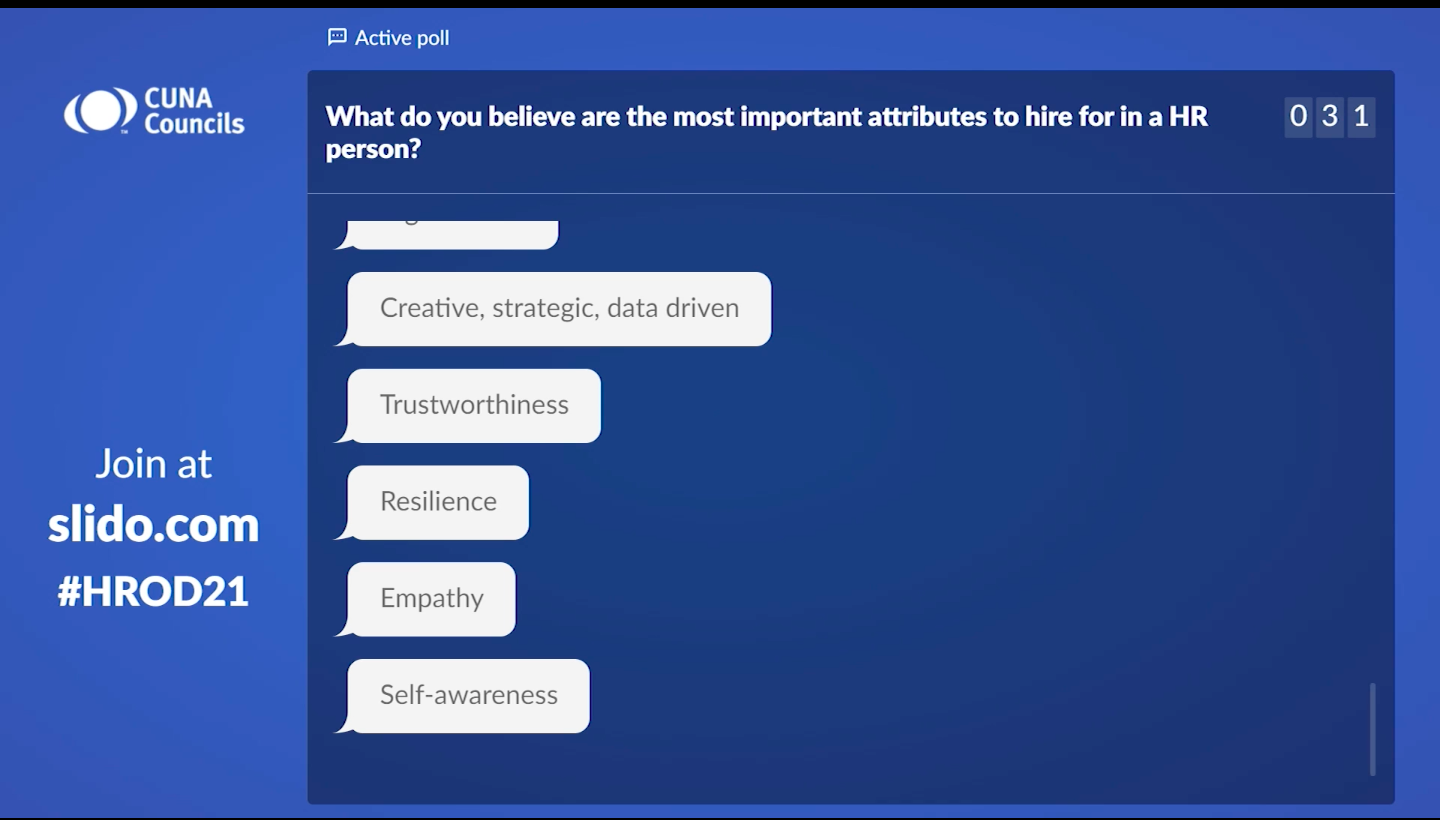

The “right” talent varies from company to company. Audience members at the conference highlighted creativity, resilience, empathy, and strategic thinking as qualities they seek in employees. Other speakers highlighted the importance of recruiting a diverse workforce in order to understand and accomplish DEI-related objectives. Whatever the attributes may be at your organization, it’s important to make sure that the people you hire match the culture you’re striving to create.

So, how do you attract these people?

Nate Brock, Director of HR at LincOne Credit Union, shared a particularly creative suggestion for developing an outstanding and diverse candidate pipeline: LincOne provides employees with “referral cards” that they can hand out to members of the community. These cards invite recipients to apply for roles with LincOne. Employees are encouraged to give them out anytime they see someone within the community living up to LincOne’s high-level values. That could be a mechanic providing above-and-beyond service, a volunteer with a penchant for community service, or anyone else who seems to fit LincOne’s culture. According to Brock, it’s proven to be a successful recruitment strategy.

The other major key to “getting the right people on the bus” is offering an incredible employee experience — which leads us right into our second point.

2. The Employee Experience Is the Member Experience

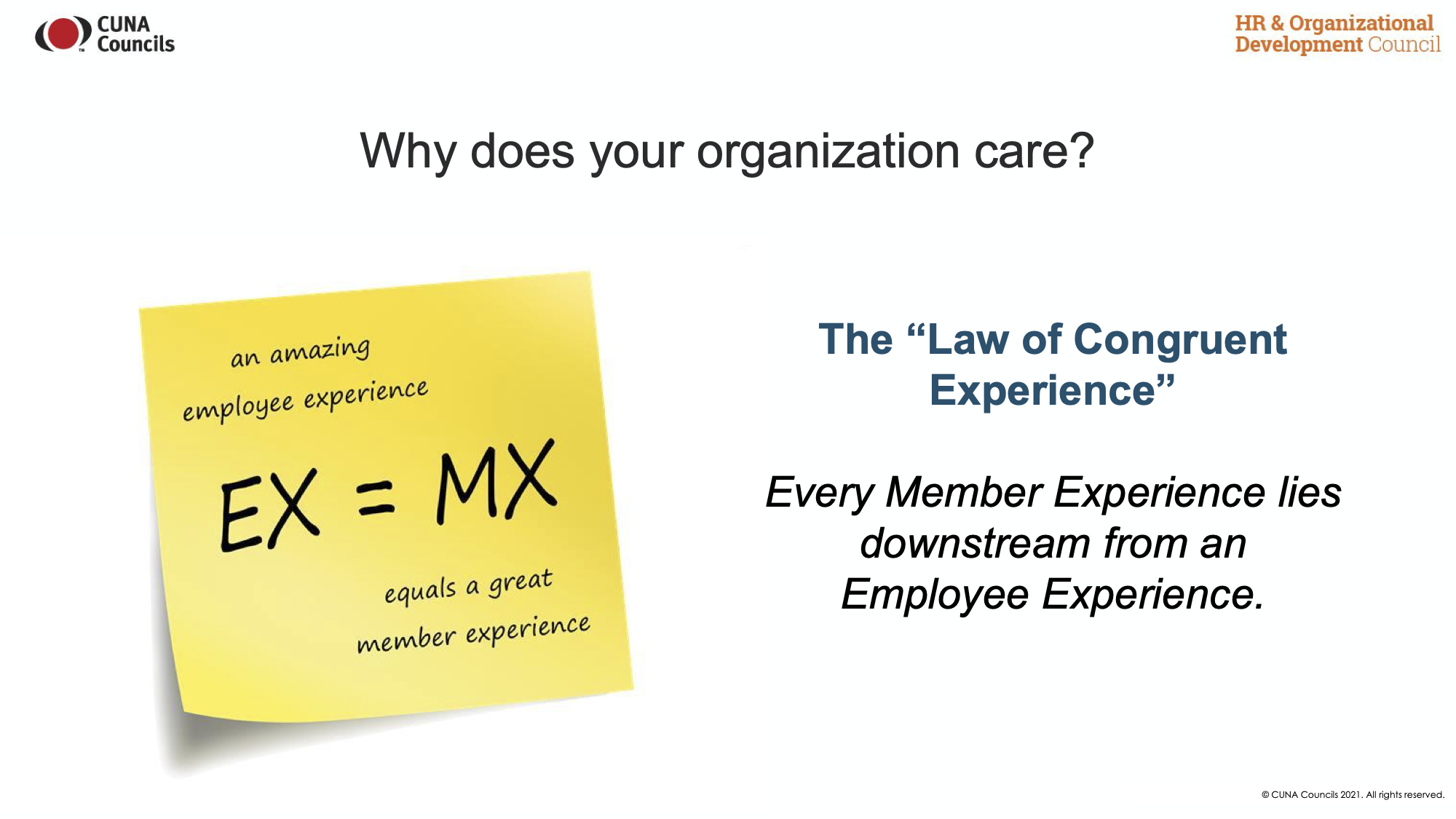

The sentiment echoed throughout the entire conference beginning in the opening session all the way through to the end: the employee experience is the member experience.

Think about it. If someone has a negative employee experience, they’ll be disgruntled and uninvested in their work which will likely interfere with their performance. Because every role at a credit union ties back to supporting members, when that employee performs poorly, the member experience suffers too. In a breakout session dedicated to this idea, Tracy Maylett, CEO at DecisionWise, referred to the concept as the Law of Congruent Experiences.

For so long, credit unions have been hyper-focused on the member experience, which, in all fairness, has historically been a key differentiator held over big banks. From marketing to recruitment and onboarding, every part of the member experience is thoughtful and intentional. In her opening address, Linda Nedelcoff, Executive Vice President and Chief Strategy Officer at CUNA Mutual Group, asked if the same can be said of the employee experience. She implied that for most credit unions, the answer is no.

This creates what Mark Sievewright, Founder and CEO of Sievewright and Associates, referred to as the “mullet problem” — everything looks fine when you’re looking at it from the front (as a member) but there’s a lot going on in the back (for employees) that needs to be addressed.

The quality of the employee experience at your credit union is a critical determinant of how engaged employees are, and employee engagement has a direct influence on performance. Maylett described highly engaged employees as individuals who are constantly learning, feel stretched by the work they do, and find personal satisfaction and fulfillment through their careers. Conversely, disengaged employees have a tendency to passively sabotage your company with apathy.

Maylett went on to explain that meaning, autonomy, growth, impact, and commitment (M.A.G.I.C.) are the key factors that contribute to a positive employee experience. While HR can provide systematic support, it ultimately falls to managers to ensure these elements are present and active for their direct reports. By focusing on M.A.G.I.C., says Maylett, you can improve the employee experience at your credit union and (as stated by the Law of Congruent Experiences) the member experience will follow.

3. The Future of Work is Flexible

Unsurprisingly, the post-COVID return to work was a recurring discussion point at this year’s conference. The consensus was clear: even after the threat of the pandemic has passed, most credit unions will continue to offer flexible working options as permitted by role.

To illustrate the depth of impact COVID-19 has had on their workforce, Mountain America Credit Union shared that prior to the pandemic, approximately 5% of their employees worked remotely. Today, that number has jumped to between 35% and 40%—and when you exclude branch employees (who by necessity have to do their roles in person), the figure jumps to 80%.

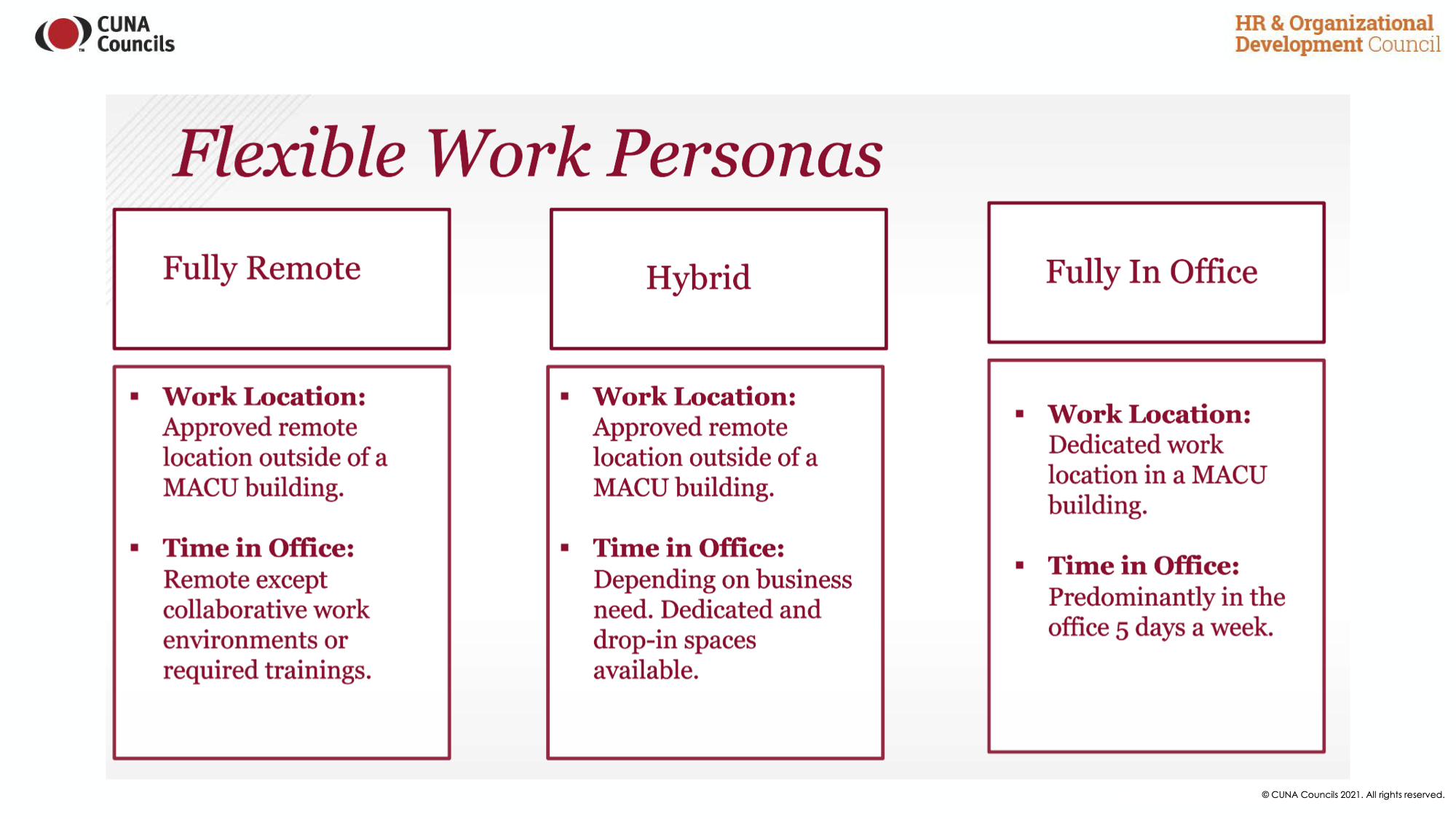

Across the board, HR leaders shared that employees have expressed interest in hybrid if not completely remote working options in a post-COVID world. For their own workforce, Mountain America Credit Union defined these new workforce in three primary categories, detailed below. Through the conference, other HR leaders shared that they are adapting similar models:

For the most part, HR leaders have accepted this as the new normal and are already seeking solutions to accommodate that preference. Whether it’s defining remote work expectations, finding ways to build a company culture that transcends the physical office, or deciding who can and cannot work from home, there are a plethora of challenges for HR leaders to consider in this new normal.

Michael Barata, Master Trainer at CultureRx, urged leaders to view the rethinking of these policies as an opportunity to unlearn what we believe about how work “should” be done. Instead of managing people and processes, Barata emphasized the importance of focusing on results and relinquishing control over how they’re achieved. If that means working odd hours, laying the 40-hour work week to rest, or abandoning outdated conventions like formal dress codes, so be it.

Barata explained, “Rather than managing the person, something to consider and have a deeper conversation around is, are we actually managing the work?” He elaborated that people tend to get too caught up managing schedules, locations, and other logistical factors when really, the only thing they should be focused on is results. Barata urged the audience to take this opportunity to rethink traditions that no longer serve the workforce and replace them with more human policies all around.

4. Digital Transformation is Essential

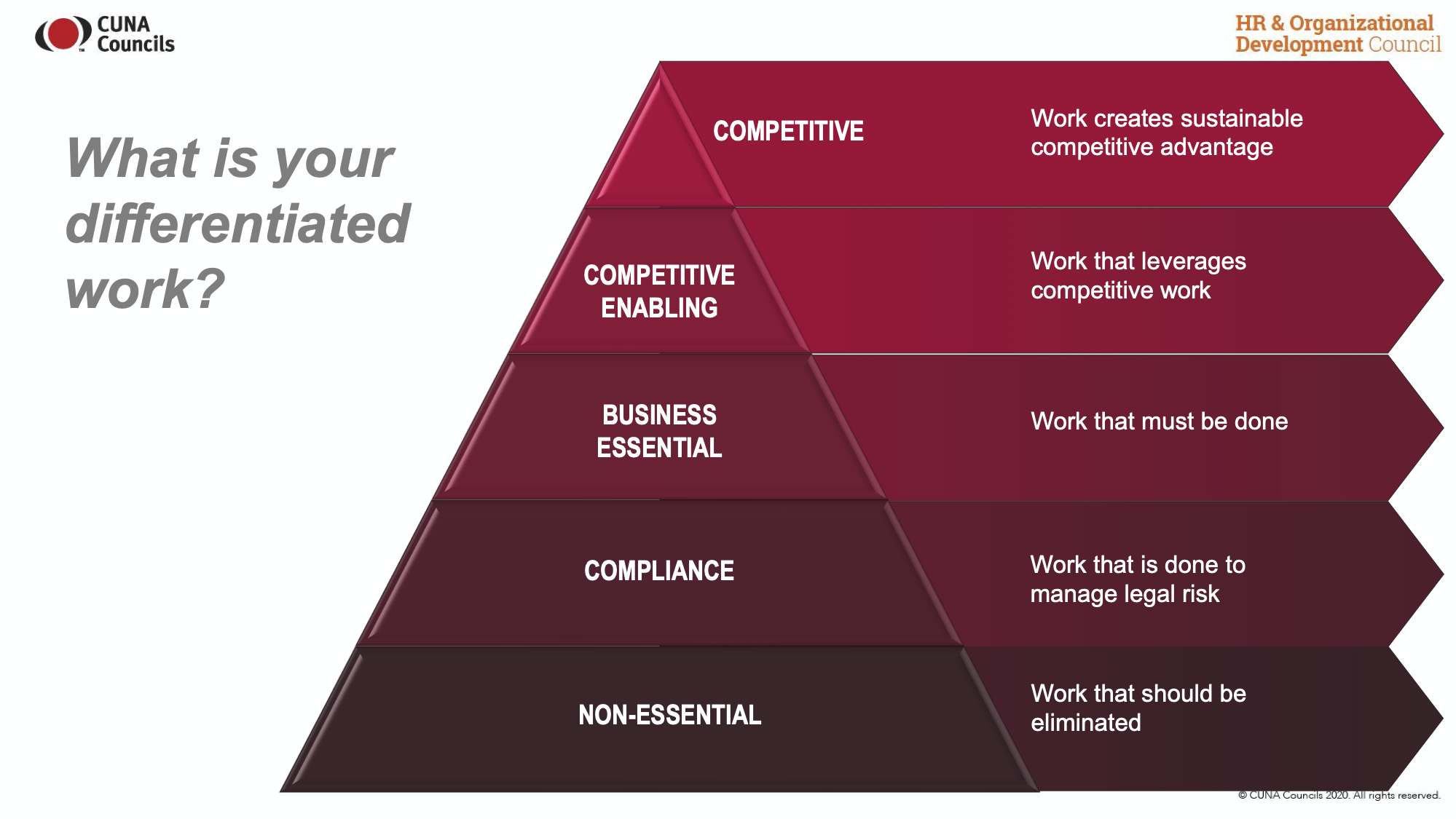

Digital transformation was yet another theme that ran throughout the conference. Trent Savage, CHRO at Mountain America Credit Union, spoke about the importance of finding ways to create more capacity so that HR teams can be less transactional and more transformational. He shared the image to the right, which illustrates the hierarchy of HR functions with most transformational at the top and most transactional toward the bottom.

Savage explained that HR leaders must seek opportunities to make the transactional elements of the HR function (things like program management, bureaucratic policies, perk negotiation, etc.) more efficient, so employees have the bandwidth to focus on more strategic business needs instead. In many cases, digital solutions offer an effective way to streamline formerly manual processes and create that capacity.

Fortunately, the financial services industry seems to be trending this way. In a session titled Financial Services Mega-Trends, Mark Sievewright, Founder and CEO at Sievewright and Associates, pointed to unprecedented advances in technology adoption and innovation as one of the most impactful factors shaping the future of the industry. He spoke to members’ increasing desire for self-service, the importance of leveraging data intelligence, and concluded that people, process, data, and technology together drive change.

The topic of digital transformation continued to come up throughout the conference as people across sessions shared their experiences with the shift to remote work and discussed how technology has been the essential tool for making that transition possible. Whether it’s for collaboration, consolidation, or customer service, digital transformation is everywhere and the credit unions best equipped to thrive in the future will be at the edge of it.

5. Employee Feedback is Key

The importance of listening to employee feedback was the fifth and final major takeaway from this year’s conference.

According to Tracy Maylett, CEO at DecisionWise, credit unions need to focus on two areas of the employee experience:

- Establishing effective methods to receive employee suggestions

- Taking action in response to these ideas and suggestions

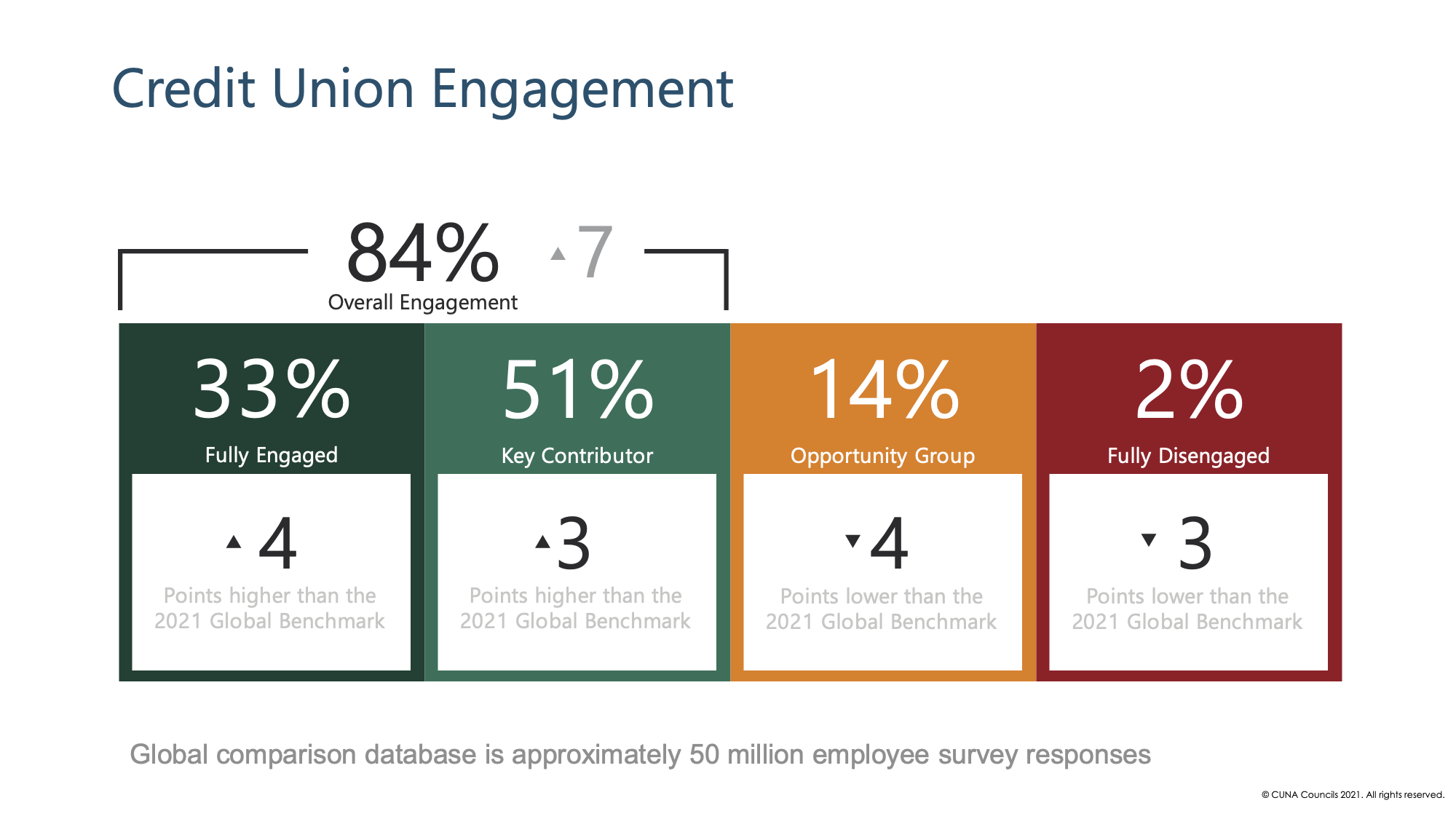

Maylett shared research indicating that although credit unions exceed global benchmarks for engagement along most dimensions (see below), they do still underperform in the two areas listed above.

Luckily, speakers at the conference shared lots of creative ideas for amplifying employee voices. Many also said that collecting and responding to employee feedback has proved to be a big benefit for their companies.

For example, Tansley Stearns, Chief People & Strategy Officer at Canvas Credit Union, shared a highly successful employee feedback program titled, “Around The Table With Todd.” The idea is to give employees the opportunity to share feedback directly with Canvas Credit Union’s CEO, Todd Marksberry. Stearns said the program has been a key strategy for maintaining culture throughout the pandemic.

Another arena where feedback is critically important is in defining and accomplishing DEI objectives. Julie Cosgrove at Affinity Plus told a story highlighting the importance of employee listening. Following the murder of George Floyd last summer in Minnesota (where Affinity Plus is based), the company’s leadership team initially decided to take a neutral stance and remain silent on the matter. It was only after listening to employee voices that they began to understand this was not a political issue, but rather an issue of fundamental human rights.

Affinity Plus responded to that feedback by not only making a public statement condemning the event, but by establishing a robust network of employee assistance programs for employees in and around the surrounding area. Through this action, Affinity Plus was able to support their team members in the way they needed to be supported.

Whatever the situation, the takeaway is clear: employees are the best source of information to get a realistic pulse on where your credit union stands now, and where it needs to go. By creating space for employees to share their feedback and taking the time to not only listen, but respond, you can make big improvements for people and your company.

Looking Forward

We left the CUNA HR & Organizational Development Council Virtual Conference feeling inspired, motivated, and optimistic about what’s in store for credit unions in the year ahead. We’re grateful to all of the speakers who shared their expertise and were delighted to have had the opportunity to sponsor such a successful event. If building up the employee experience is a priority for your credit union in 2021, don’t hesitate to reach out to Fond for support. We remain a dedicated employee recognition resource for credit unions everywhere.

Katerina Mery is a Marketing Specialist at Fond with a background in cognitive psychology and a passion for improving the way people live and work. She especially enjoys learning about how to accomplish this through rewards and recognition. In her spare time, you can find Katerina running outside, admiring art, and exploring the latest and greatest local restaurants.

Katerina Mery is a Marketing Specialist at Fond with a background in cognitive psychology and a passion for improving the way people live and work. She especially enjoys learning about how to accomplish this through rewards and recognition. In her spare time, you can find Katerina running outside, admiring art, and exploring the latest and greatest local restaurants.